Vendors must use UBL 2.1 CIUS-PT and CEFACT CIUS-PT to send signed e-invoices. Other independent bodies can use other platforms as long as they follow eSPap standards. State and public authorities have to use eSPap’s platform to receive invoices. Portugal electronic invoice requirements for public procurement processes? Microenterprise has below ten employees, and its yearly turnover or balance sheet is 2 million euros or less.Small enterprise has less than 50 people, and their total yearly turnover or balance sheet is 10 million euros or less.Medium-sized enterprise has less than 250 employees, earns 50 million euros or less, and the total yearly balance sheet is 43 million euros or less.Large enterprise has over 250 people, earns over 50 million euros in a year, and the balance sheet totals 43 million euros in a year.The classifications go the following way: The eSPap classifies enterprises using employee number, balance sheet volume, and turnover. micro-enterprises and public entities- they were required to issue e-invoices in public transactions from January 2022.Non-established businesses- mandatory B2G e-invoicing was postponed to 1 July 2021.

The “Entidade de Serviços Partilhados da Administração Pública I.P.” or “eSPap” is the government entity responsible for implementing electronic invoicing. Tax authorities can decrease the VAT gap and stop tax evasion through real-time digital control of transactions. The tax clearance model allows continuous transaction controls (CTC). Read also: Easily Comply With European E-invoicing RegulationsĮlectronic invoicing in Portugal is a tax clearance model by the government.

Edi invoicing how to#

You will also learn Portugal's e-invoice requirements and how to exchange and process e-invoices in public procurement. In this article, you will understand e-invoicing and if it's mandatory in Portugal. New rules and regulations concerning Business to Government e-invoicing are now in place. The Portuguese Government aims to reduce tax fraud and close the difference between the collected and expected VAT revenue.

Portugal is developing its electronic invoicing system mandate like other European countries.

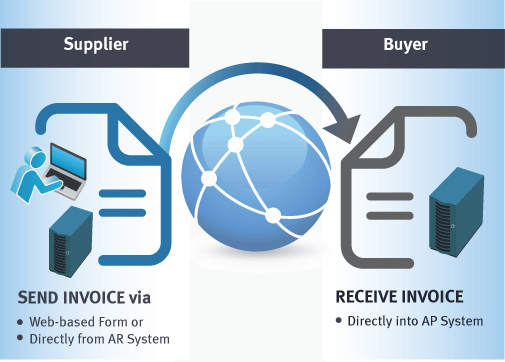

Vendors must use UBL 2.1 CIUS-PT or CEFACT CIUS-PT to send signed e-invoices. Electric Invoicing is mandatory in the Business to the Government sector in Portugal.

0 kommentar(er)

0 kommentar(er)